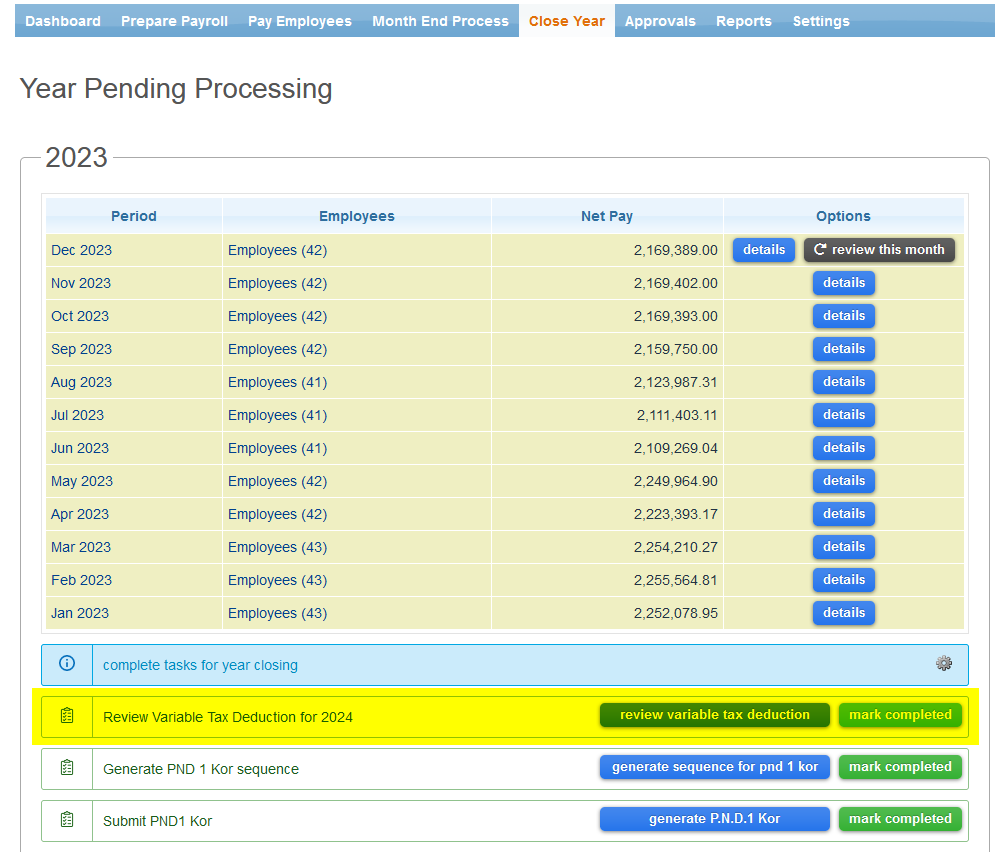

1.Review details of Variable Tax Deductions for the new year

Before starting payroll process for the upcoming year, it is crucial to undergo the “Review Variable Tax Deduction for 2024” procedure available in the Close Year menu.

During this process, you have the flexibility to choose whether to remove all, keep all, or selectively keep specific variable tax deductions.

Note that the system will automatically keep standard tax allowances, such as;

- Spouse Allowance

- Less Income Exemption

- Child Allowance

- Parental Care Allowance

- Support for Disabled or Incompetent Persons

- Once you’ve determined your approach to variable tax allowances, you can decide whether you would like the system to send an email to employees or you want to manage the changes manually.

If you need to notify an employee via email, you can customize the message that the system sends to the employee.

2.Create 2024 Payroll schedule

Next step is to review the Payroll Schedule:

1. Navigate to Menu > Settings > Payroll Schedule

2. Click on the “Add Record” button

3.Select “Manage Schedule” to review and adjust the payroll schedule according to your organisation’s requirements.

4. After making necessary adjustments, click “Add” to finalize the setup.

Thats it! Your system is now ready to start processing payroll for the new year.

For any inquiries or assistance, feel free to email to support@gainplus.asia or call 02 401 9250.